Pay Sales Tax in QuickBooks Enterprise Solutions (Toll Free Number : +1-877-249-9444)

- Sellers

- Deals Tax

- Deals Tax Liability

Come back to Vendors, Sales Tax, at that point select Pay Sales Tax:

At the point when the window opens, pay one office at any given moment… first do the one that correct (normally NV Dept of Taxation – City of East Bayshore in this illustration). Make sure to set the right financial balance from which to deduct the monies, at that point set the date of the withdrawal and above all, set the assessment risk date – ought to be a month ago under show deals charge due through date. At last decide whether you need QB to appoint a check number or in the event that you want to do as such at a later time, select "to be printed":

Presently come back to Vendor, Sales Tax, Pay Tax window to pay the expenses that require adjusting:

- Select all expenses (they both go to a similar duty organization)

- Select the ADJUST catch

- In this illustration, the installment can be gathered together or down… we will round up to 1637.00

Take after the case above:

- Check that the alteration influences the assessment time frame you wish to change… Nov 2019 in this

- Example

- Ensure the seller consents to the office in your Tax window.

- Select the balance account, for example, Other Income or Other Expense contingent on Increase/Decrease

- Increment or reduction the assessment payable – in this illustration increment by 37 pennies

- Make an update in the event that you like, for example, adjusting to pay even dollar to CABOE

Select OK to come back to the Sales Tax Payment Window

Confirm that the financial records, date of check, date of risk, and beginning check number or

"to be printed" are still as they ought to be.

Presently Select "Pay All Tax Button"

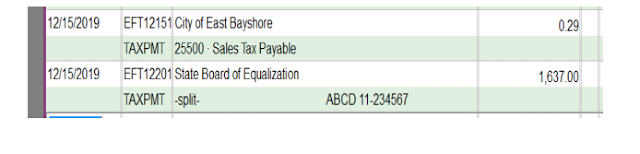

Go to the check enlist to confirm that your checks have been appropriately recorded and are

holding up as "To Print" for you to either enter a check date or eft note.

When you make your installments on the web, change the To Print notice to the real documentation such as EFT, DD, Online and confirm that 2 checks are in the enroll each to the best possible office

For any more inquiries or concerns call The QuickBooks Call!QuickBooks support number: +1-877-249-9444

I wanted to read your blog, I enjoyed reading your blog. there is a lot of good information on your blog, I loved reading and I think people will get a lot of help from this blog. Sam, I have written this kind of blog, You can also read this blog. I think you will get a lot of help from this too I hope you got a lot of help from this blog. For other information in the future

ReplyDeletevisit for site

If you have any kind of trouble in sending or receiving AOL mail or have any other AOL related issue and need some human help to get a solution. Contact AOL Phone Number

ReplyDeleteThanks for sharing this information. We are the best QuickBooks Support provider and helps you when you stuck in any error while you are using this software.

ReplyDeleteInstall QuickBooks desktop

Thanks for sharing such a great information with us. We have the finest Quickbooks experts, so If you're facing trouble in your QuickBooks software then just go through with these given links:

ReplyDeleteFix QuickBooks Abort Error

Thanks for sharing such a great information with us.QuickBooks is an exemplary accounting software that give eminent benefits to the user. Perform all accounting tasks easily that involves managing of expenses, inventory tracking, estimating payroll, etc.

ReplyDeleteQuickBooks Premier Support Phone Number

Thanks for sharing such a great information with us.Nice Blog ! Looking for support to resolve your issues with QuickBooks ? Don't be afraid! We're here to provide you with the best solutions..

ReplyDeleteQuickBooks Desktop Support Phone Number

ReplyDeleteI really happy found this website eventually. Really informative and inoperative, Thanks for the post and effort! Please keep sharing more such blog.

RESOLVE QUICKBOOKS ERROR 1603

Very interesting information for all the small business owners. Are you stuck with issues and errors? Our certified experts are standing by to help you fix It instantly. Get instant online support 24/7. Call now at : +1-800-496-0147 (Toll-Free)

ReplyDeletequickbooks support phone number

quickbooks 24/7 support phone number

This is an awesome motivating article! It is well-written and contains all the info, your Post is very unique. Thank You for posting such a nice article.

ReplyDeleteBookkeeping Services

Bookkeeping Services in Denver

Houston bookkeeping